Integrated solutions built to scale, secure, and empower your business for the future.

BankVision | The Enterprise Video Banking Ecosystem

1. The Customer Experience: Simple. Secure. Seamless.

Don’t let technical friction kill your conversion rates. BankVision provides a browser-based and mobile-friendly interface that requires no heavy downloads.

Instant Connectivity: One-click initiation for video calls with Relationship Managers.

Guided Onboarding: Step-by-step visual cues for document scanning and identity verification.

Zero Learning Curve: Designed for all demographics, from tech-savvy Gen Z to seniors.

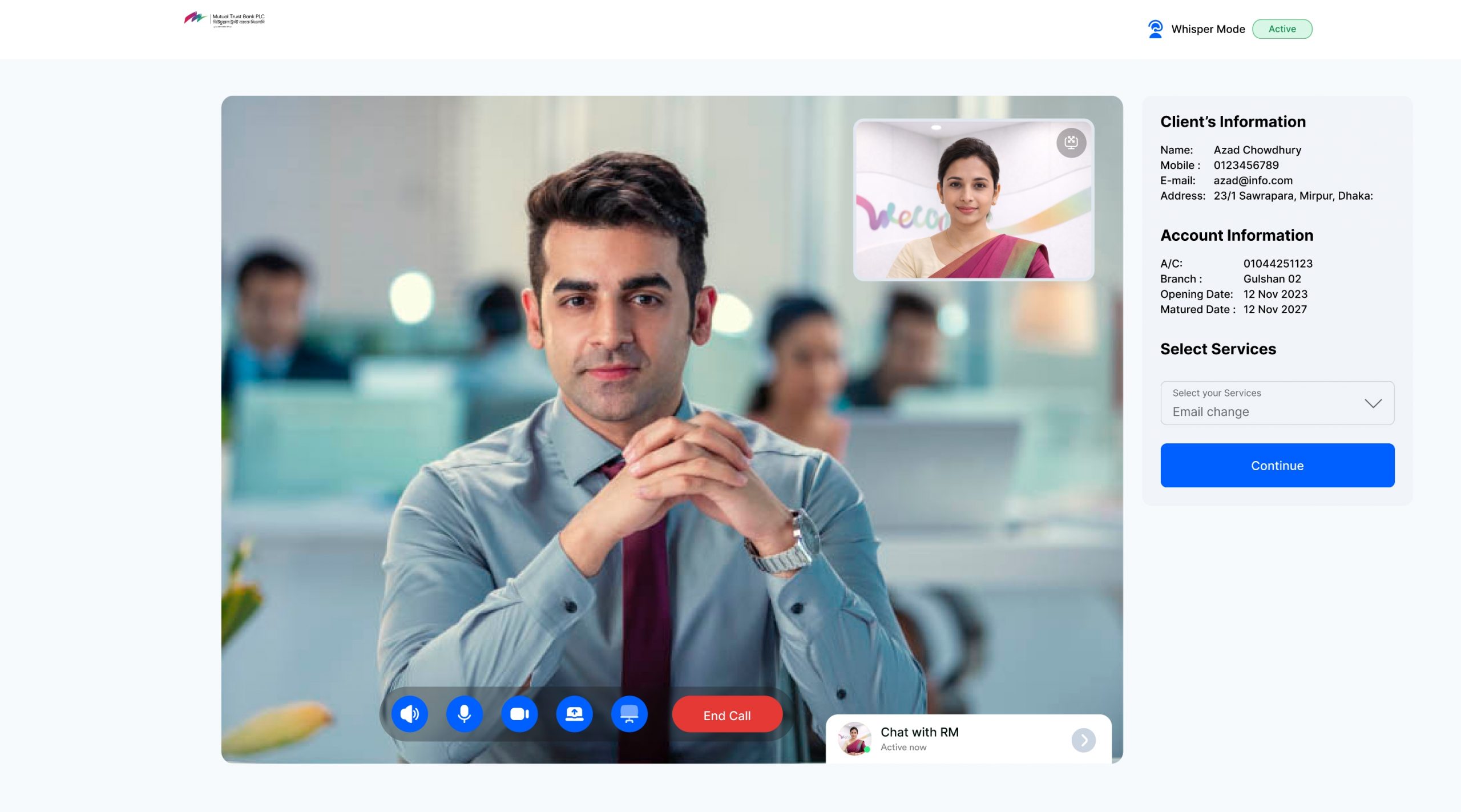

2. The Relationship Manager (RM) Portal: The Digital Desk.

Empower your staff with the tools they need to close deals and resolve issues faster.

Integrated Workspace: View customer profiles and interaction history in a single pane of glass.

Live Collaboration: Securely chat with senior experts or supervisors during a live call to resolve complex issues instantly.

Smart Queue Management: A real-time waiting list ensures no customer is left hanging, optimizing RM idle time.

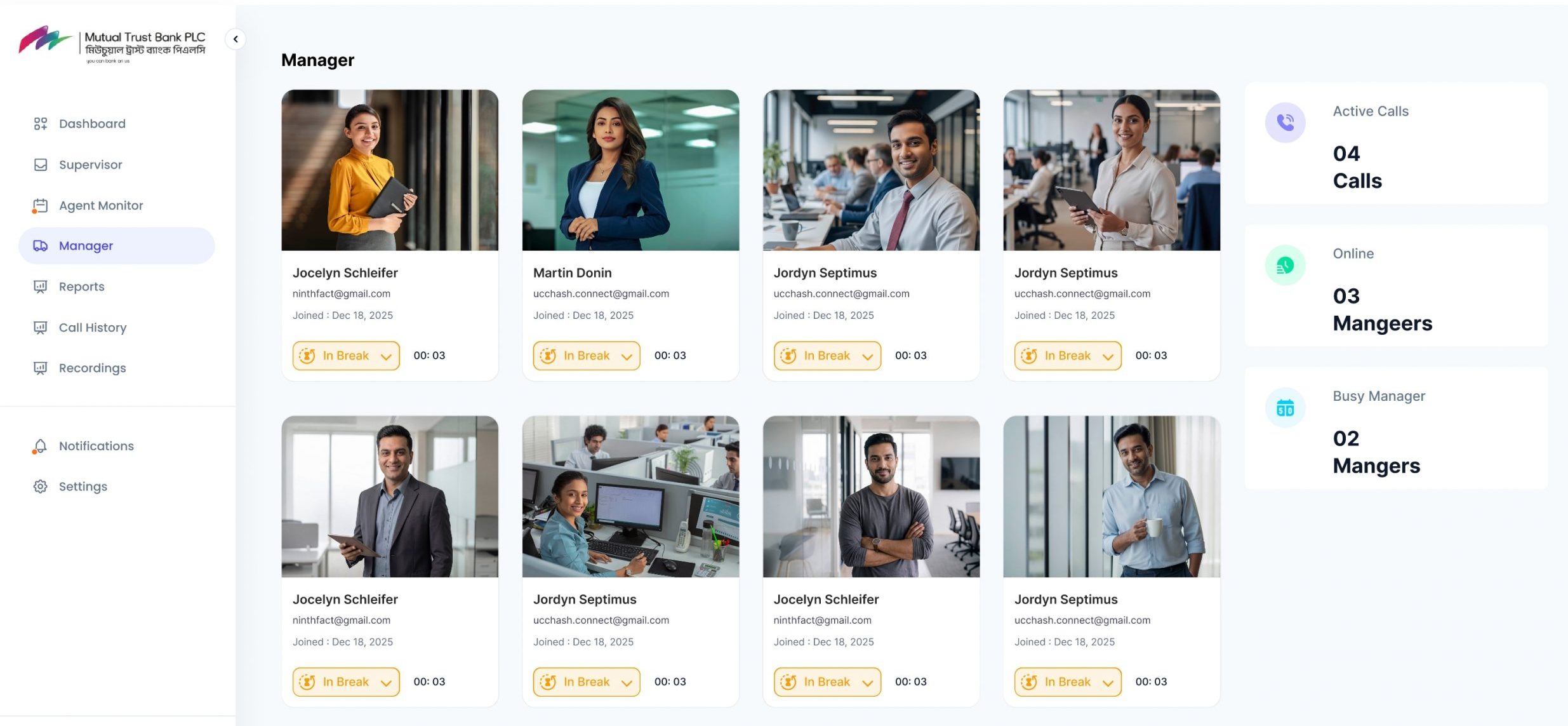

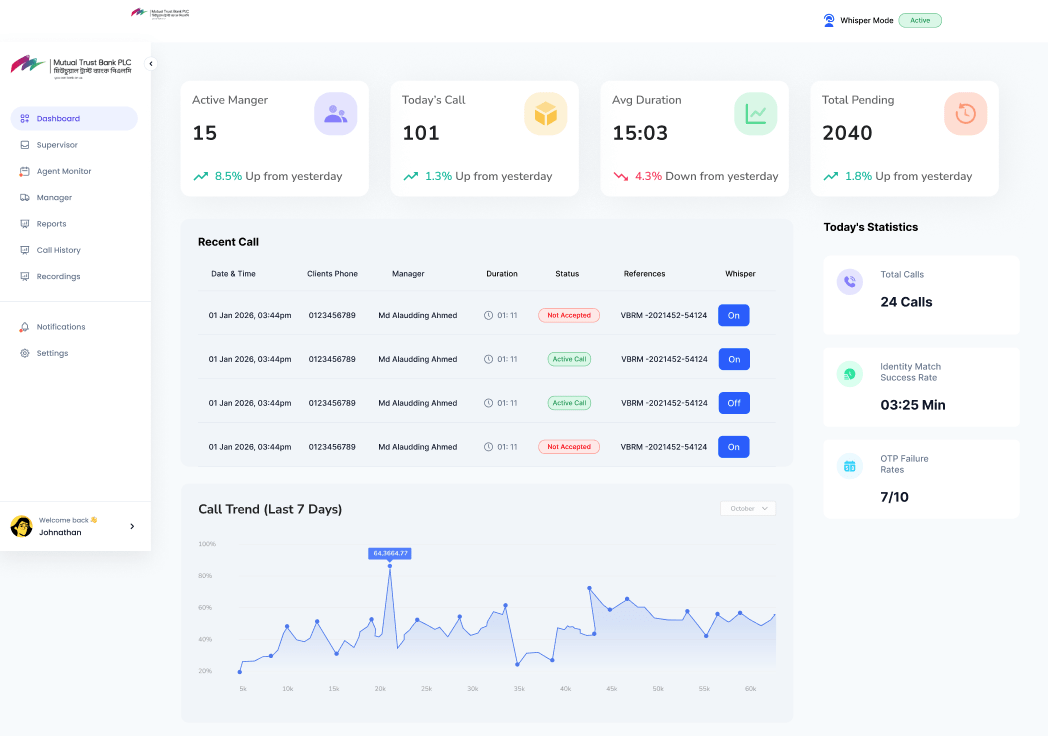

3. The Admin Command Center: Total Visibility.

Maintain full control over your digital branch performance and compliance.

Performance Analytics: Monitor call durations, RM availability, and customer satisfaction scores in real-time.

Compliance & Audit: Comprehensive logs and session tracking to meet global regulatory requirements (GDPR/HIPAA).

Resource Allocation: Manage roles, permissions, and internal communication from a centralized dashboard.

Beyond the Video Call: Real Solutions for Real Banking.

Remote Account Reactivation: Bring dormant accounts back to life with secure, live identity verification.

KYC & Identity Validation: Use AI-powered facial recognition and document scanning during live sessions.

Personalized Consultations: Move from transactional banking to advisory banking with high-definition video for loan and mortgage discussions.

Profile Updates: Securely update sensitive data (mobile numbers, addresses) through verified video protocols.

BankVision isn’t just a video tool; it’s a banking-grade security platform.

Bank-Level Encryption: End-to-end encryption for all video and data transmissions.

Seamless Backend Integration: Our API-first architecture integrates with your existing Core Banking System (CBS) without requiring a total infrastructure overhaul.

Regulatory Readiness: Built-in features to assist with KYC, AML, and data protection standards worldwide.

Measuring the Success of BankVision.

Lower Costs: Reduce the cost-to-serve by centralizing your RM team.

Higher Efficiency: Decrease branch traffic for routine updates, freeing up physical staff for high-value sales.

Faster Turnaround: Identity verification that used to take days now takes minutes.

Future-Ready: Position your bank as a digital leader in an increasingly competitive landscape.

Why BankVision?

- Secure: Enterprise-grade encryption and live identity verification.

Convenient: Bridges the gap between digital speed and human trust.

Integrated: Seamlessly connects with your existing core banking backend.

Scalable: Reduces physical branch traffic while increasing service capacity.

Services outcome

Here are six key outcomes you can expect from our Frontend Engineering service, crafted for digital growth:

- Boost User Engagement

- Improve SEO & Core Web Vitals

- Enable Cross-Platform Reach

- Ensure Accessibility & Compliance

- Gain Actionable Insights

- Support Scalable Growth